2 of my top cheap FTSE 250 shares to consider buying before April!

Picture supply: Getty Photos

I imagine these low cost FTSE 250 shares might too low cost to overlook at present costs. Right here’s why I believe buyers looking for prime worth shares ought to give them severe consideration.

Centamin

Having publicity to gold may be a good way for buyers to diversify and cut back threat. When instances get powerful and monetary markets sink, safe-haven gold typically rises in worth and offsets weak point elsewhere in a person’s portfolio.

I believe investing in gold shares is a wonderful solution to obtain this. In contrast to bodily gold, or a product that tracks metallic costs like an exchange-traded fund (ETF), many mining corporations additionally present earnings within the type of a dividend.

To this finish, Centamin (LSE:CEY) is one UK share by myself radar at the moment. Its dividend yield sits at a strong 3.2% for 2024.

Mining shares may also present higher returns than gold or gold-backed monetary devices if they will exhibit ongoing operational energy. Profitable enlargement of its flagship Sukari mine in Egypt, constructive exploration work elsewhere in Africa, and a decent grip on prices all recommend to me a inventory with sensible funding potential.

Earnings at commodity shares are notoriously unstable given their sensitivity to uncooked materials costs. However regardless of this threat, I believe Centamin shares are a wonderful purchase.

This isn’t solely due to the miner’s all-round cheapness. In addition to offering that wholesome dividend yield, it trades on a ahead price-to-earnings (P/E) ratio of 8.7 instances.

It’s additionally because of the chance that gold costs will proceed to soar. The yellow metallic hit one other all-time excessive of $2,222.39 per ounce on Thursday (21 March).

Metropolis analysts definitely assume Centamin’s share worth will proceed its current speedy ascent. The 11 analysts with scores on the miner have put a 12-month worth goal of 203p per share on it. That’s a big premium from present ranges of 111p.

Greencoat UK Wind

Renewable vitality inventory Greencoat UK Wind (LSE:UKW) additionally seems massively undervalued for my part.

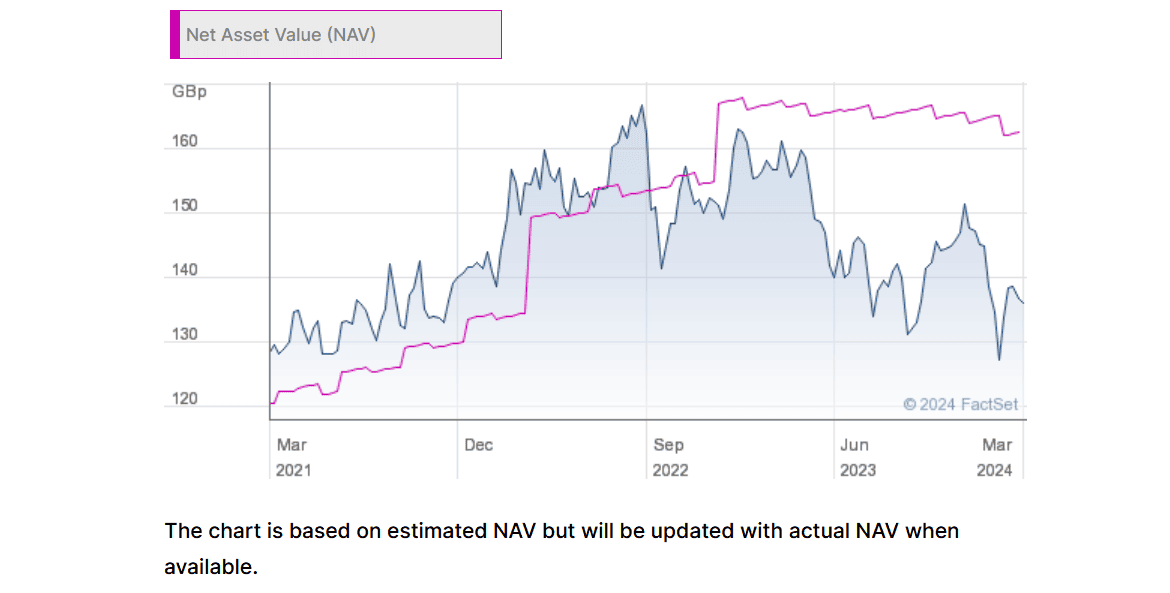

Its P/E ratio of 25.8 instances won’t look too interesting to buyers. However at 135.6p per share, it trades at a double-digit low cost to its estimated web asset worth (NAV) per share of 162.9p

The seven brokers with scores on Greencoat additionally assume its share worth will hit 178.8p per share within the subsequent 12 months.

And at last, the wind energy specialist carries a tasty ahead 7.4% dividend yield at present costs. That’s greater than double the three.5% common for FTSE 250 shares.

Earnings at renewable vitality producers are typically extra unstable than these utilizing fossil fuels. Within the case of Greencoat, energy technology can sink throughout calm circumstances. Constructing generators and holding them up and working may also be enormously costly.

But I’d be completely happy to simply accept some volatility if a inventory’s long-term outlook is shiny. And I believe Greencoat — which operates dozens of onshore and offshore wind farms — might ship strong earnings development because the world switches from oil and gasoline to cleaner vitality sources.