7.2% and 4.5% yields! Should I buy these FTSE 100 dividend shares to target a million-pound ISA?

Picture supply: Getty Photographs

Investing in dividend shares could be an effective way to construct a considerable nest egg for retirement. One technique I’m utilizing to attempt to get wealthy is to spend money on FTSE 100 dividend shares.

Any dividends I obtain are ploughed again into shopping for extra UK shares. In order the variety of shares I personal grows, the quantity of dividends I obtain additionally rises which, in flip, provides me more cash to purchase shares… you get the concept.

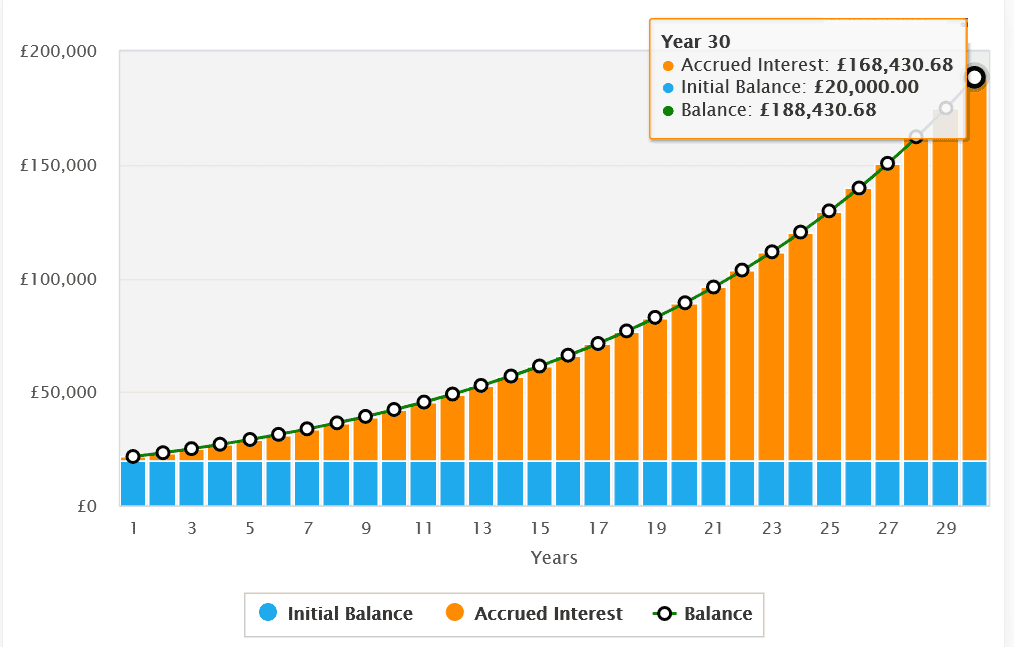

This idea of “incomes curiosity on my curiosity” is named compounding. It’s an impact that accelerates over time, and over a interval of many years can turbocharge an investor’s wealth, as proven under.

On this instance, a £20,000 lump sum funding might flip into £188,430.68 over 30 years. That’s based mostly on the 7.5% common annual return of Footsie shares since 1984.

Millionaire shares

Investing in FTSE 100 dividend shares is maybe one of the best ways to play the compounding theme.

Massive-cap shares normally have higher monetary energy and earnings resilience than smaller firms. Mixed, these qualities normally give them the firepower to pay giant and growing dividends over the long run.

Latest information from AJ Bell exhibits it is a frequent tactic with the ISA millionaires it has on its books. The ten hottest UK shares with this set of traders all commerce on the FTSE 100. And 7 of those — together with Lloyds, Authorized & Common and Nationwide Grid — all carry dividend yields above the three.8% index common.

A well-liked FTSE inventory

Shell (LSE:SHEL) sits on the high of this hallowed record. In line with AJ Bell, some 39% of the ISA millionaires it providers have the oil producer of their portfolio.

That is unsurprising at first look. Shell — which sits within the high 10 alongside BP — has distinctive money flows that permits it to pay stable dividends.

Demand for oil shares has elevated too, following the latest leap in power values.

Whereas oil costs might stay strong, I don’t plan to purchase Shell shares for my ISA, regardless that they provide a 4.5% dividend yield. The long-term funding outlook right here stays unsure as electrical car gross sales and demand for renewable power takes off.

The FTSE inventory isn’t doing itself any favours by scaling again its inexperienced power technique both. It now plans to cut back the online carbon depth of the power it sells by 15% to twenty% by the top of the last decade as new fossil gas tasks come on-line.

That is down from a earlier goal of 20%.

A greater purchase

I’d a lot slightly use any spare money to extend the variety of Aviva (LSE:AV.) shares I personal. It has a far clearer path to producing long-term income and, by extension, dividends in my portfolio.

The monetary providers area is exceptionally aggressive so firms like this must paddle extraordinarily onerous to win enterprise.

However Aviva — which carries a 7.2% dividend yield — has proven it has the instruments to thrive on this cut-throat surroundings. It’s the most important supplier of basic and life insurance coverage within the UK, and has main positions in Eire and Canada.

And the corporate can have terrific alternatives to develop enterprise throughout its safety, insurance coverage and retirement strains because the aged populations quickly broaden. This is the reason 28% of AJ Bell’s ISA millionaires at the moment maintain Aviva shares.