Could the JD Sports Fashion share price double in the next five years?

Picture supply: Britvic (copyright Evan Doherty)

Wanting on the share worth of JD Sports activities Vogue (LSE:JD) over the previous 5 years, it has moved in the precise course – however not dramatically. In that interval, the shares are up 22%.

But when I had purchased the shares 5 years in the past and bought them in November 2021, I might have seen my holding improve by over 130% in worth.

Since then, the share worth has nearly halved.

So, if I purchase now, may I hope to see the value double once more within the coming 5 years? In any case, that might solely require the shares hitting the identical worth that they reached in 2021.

Confirmed enterprise mannequin

Sure, I do assume the shares might double within the coming half-decade.

I’ve added extra to my portfolio in latest months exactly as a result of I felt the share worth appears engaging.

JD has a easy however confirmed mannequin — a retail property spanning bodily shops and an enormous on-line presence, throughout markets from Europe to Australia to the USA.

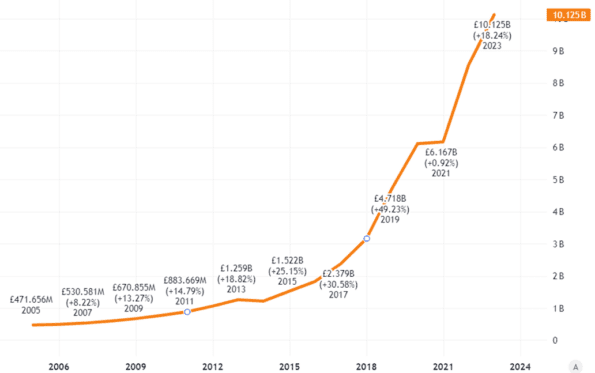

That has been the lever for explosive development. Revenues have surged.

Supply: TradingView

I anticipate that to proceed. The corporate plans to open a whole lot of latest shops yearly. Final 12 months alone it opened over 200.

This enlargement has added economies of scale and helped deepen the model’s enchantment, buyer base and operational experience. I feel these are all aggressive benefits.

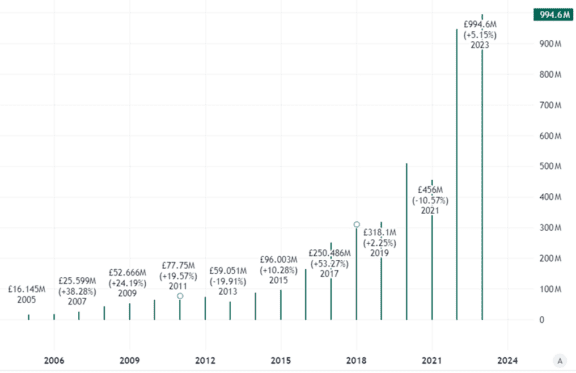

Not solely has income soared, so has working revenue.

Supply: TradingView

Prospects of future success

However companies can face a number of non-operating prices, particularly in the event that they need to spend cash on vital enlargement.

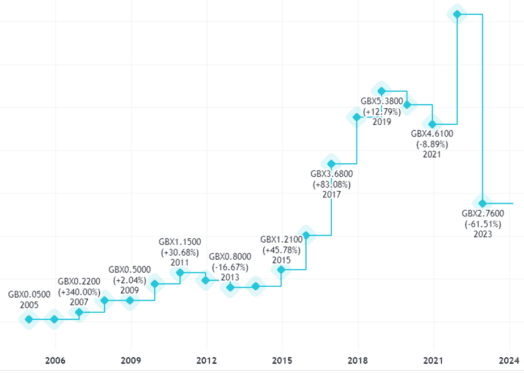

That helps clarify why, regardless of working revenue of near £1bn yearly, earnings per share at JD Sports activities are pretty small, at underneath 3p.

Supply: TradingView

That implies the corporate is buying and selling on a price-to-earnings ratio of round 45. That doesn’t sound low cost in any respect.

However with the corporate promoting for round £6.4bn in whole, whereas holding over £1bn in internet money, I feel the valuation truly is engaging.

In any case, the corporate appears to have robust development prospects.

Upbeat buying and selling assertion

That has been affirmed right now (28 March) after the discharge of a buying and selling assertion masking final 12 months.

In January, the JD Sports activities share worth crashed after a revenue warning. It lowered forecast revenue earlier than tax and adjusted gadgets for final 12 months to be £915m-£935m. The enterprise mentioned right now it has delivered on these expectations.

For the present 12 months, earlier than any accounting changes, it expects pre-tax revenue of £900m-£980m. Seven weeks into its present monetary 12 months and buying and selling has been consistent with expectations, in keeping with the replace.

The sportswear market has been massively aggressive, resulting in heavy discounting. That continues to be a danger to revenue margins at retailers together with JD Sports activities.

However in a tricky market, it’s holding its personal and increasing.

I anticipate the corporate to develop gross sales considerably and see its worth relative to pre-tax revenue as a cut price.

May we see the outdated JD Sports activities share worth matched in coming years, that means the shares double from right now? Presumably, if earnings per share additionally develop strongly sufficient from the place they’re. The corporate might obtain that by slicing non-operating prices, rising revenues considerably or each. I see these as potentialities in coming years — however there may be numerous work nonetheless to be completed.