Ripple Forecasted To Hit $1.17, XRP Forms ‘W’ Pattern

Ripple’s native cryptocurrency, XRP, has been making waves available in the market because it kinds a promising ‘W’ sample, indicating a possible breakout within the close to future. In line with a latest tweet by analyst EGRAG Crypto, the present scenario means that the MACRO ‘GO-GO’ stage is imminent, which might result in important value appreciation for XRP.

The analyst highlights the significance of the Fibonacci 0.382 stage, which at the moment stands between $0.58 and $0.60. This stage acts as a powerful assist for XRP, and so long as the cryptocurrency doesn’t shut beneath this vary on a weekly or 3-day candle, the bullish sentiment stays intact.

Whereas wicking candles are thought-about regular, a closure beneath the Fib 0.382 stage might increase considerations amongst traders.

Might XRP hit $1.17?

Upon nearer examination of the XRP chart, EGRAG Crypto factors out that the ‘W’ sample is certainly taking form. This, in response to the analyst, indicators a possible breakout. The measured transfer for this sample varies relying on the dimensions used. On a logarithmic scale, the goal stands at a formidable $1.17. Nonetheless, on a non-logarithmic scale, the goal is barely decrease at $1.02.

Ripple Value Efficiency

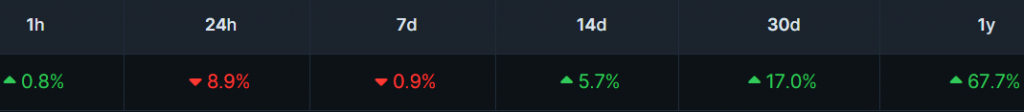

Regardless of the promising outlook, XRP has skilled a short-term dip in value, with a 0.9% lower over the previous 7 days and an 8.9% lower within the final 24 hours. Nonetheless, zooming out to the 30-day and 1-year timeframes reveals a extra optimistic image, with XRP recording good points of 17.0% and 67.7%, respectively.

These figures counsel that whereas short-term volatility is current, the general development for XRP stays bullish. Because the ‘W’ sample continues to develop, traders and merchants are conserving an in depth eye on the cryptocurrency’s value motion, eagerly anticipating the potential breakout and subsequent value surge.

It’s price noting that Ripple, the corporate behind XRP, has been engaged in a long-standing authorized battle with the U.S. Securities and Alternate Fee (SEC). The SEC alleges that Ripple carried out an unregistered securities providing by way of the sale of XRP, whereas Ripple maintains that XRP will not be a safety and must be handled as a digital forex.

The result of this authorized battle might have important implications for XRP’s future value efficiency. A positive ruling for Ripple might additional bolster investor confidence and probably result in elevated institutional adoption of the cryptocurrency. Then again, an unfavorable end result might put downward stress on XRP’s value.